Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Saratoga form refers to a method of presenting horse racing information in a standardized format. It is named after Saratoga Springs, a popular horse racing venue in New York. Saratoga form provides detailed information about past performances of horses, including statistics such as wins, finishes, jockey and trainer records, track conditions, and other relevant data. This form is used by bettors to analyze and make informed decisions when placing bets on horse races.

Who is required to file saratoga form?

It appears that you may have meant to refer to a specific form related to Saratoga, such as the Saratoga Form 1099-INT or Saratoga Form 1099-DIV. However, without more specific information regarding the context or purpose of the form, it is difficult to determine who would be required to file it.

If you can provide additional details, I will be happy to assist further.

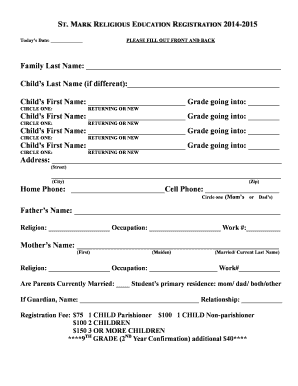

How to fill out saratoga form?

To fill out a Saratoga form, follow these steps:

1. Obtain the Saratoga form: You can usually find this form online on the official website of Saratoga or the organization that requires it. Download the form or obtain a physical copy if necessary.

2. Read the instructions: Before filling out the form, carefully read the accompanying instructions. These instructions will guide you through the form-filling process and provide any specific requirements or guidelines.

3. Gather necessary information: Collect all the relevant information that is required to complete the form. This might include personal details, contact information, identification numbers, financial information, or any other specifics mentioned in the form.

4. Start with personal details: Begin by providing your personal information such as your full name, address, date of birth, and contact details. Make sure to enter the information accurately and legibly.

5. Fill in specific sections: Proceed to fill out any specific sections or fields mentioned in the form. These can vary depending on the purpose of the Saratoga form. For example, if it is a medical form, you may need to provide information about your health history or current medical conditions.

6. Provide supporting documentation: If the Saratoga form requires any supporting documentation, such as identification proofs, certificates, or receipts, ensure that you attach these documents as instructed. Make sure to make copies of any original documents.

7. Review and verify: After completing the form, carefully review all the information provided. Check for any errors, missing data, or inconsistencies. It is essential to ensure accuracy and completeness.

8. Sign and date: Finally, sign and date the Saratoga form in the designated spaces. This signature signifies your consent and acknowledgment of the information provided.

9. Submit the form: Submit the filled-out Saratoga form as required. This might involve mailing the physical copy or uploading the form online, depending on the instructions provided.

Remember to keep a copy of the completed Saratoga form for your records as well.

What is the purpose of saratoga form?

The Saratoga form is a type of racehorse performance evaluation form used in the horse racing industry. Its purpose is to provide valuable information and statistics about a horse's past performance, as well as its potential for future races.

The form typically includes details such as the horse's name, age, weight, jockey, trainer, and owner. It also lists the horse's recent racing history, including the date, racetrack, distance, finish position, time, and other relevant details. This information helps bettors and racing enthusiasts analyze a horse's performance and make informed decisions when placing bets.

Additionally, the Saratoga form may include useful stats like the horse's win, place, and show percentages, as well as its earnings and speed figures. It helps in assessing the horse's overall racing ability, consistency, and suitability for different race conditions.

By studying the Saratoga form, trainers, owners, and racegoers can gain insights into a horse's form, capabilities, and potential to compete effectively in upcoming races. This information is crucial for evaluating competition, predicting outcomes, and making strategic decisions in the horse racing industry.

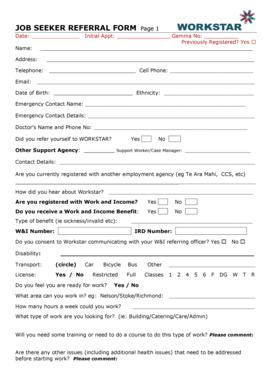

What information must be reported on saratoga form?

The Saratoga form is a standardized reporting form used by hospitals and healthcare organizations to collect and report data on patient safety incidents, such as adverse events, near misses, and other incidents that may affect patient care. The specific information that must be reported on the Saratoga form includes:

1. Patient information: Demographic details of the patient involved in the incident, such as name, age, gender, medical record number, and contact information.

2. Incident details: Description of the incident, including date, time, and location of the occurrence. This may also include a narrative of what happened and any contributing factors.

3. Harm or potential harm assessment: Categorization of the incident based on the level of harm or potential harm caused to the patient, following a standardized scale (e.g., no harm, temporary harm, permanent harm, death).

4. Event type: Classification of the incident into specific event types, such as medication errors, falls, surgical complications, healthcare-associated infections, etc.

5. Contributing factors: Identification of any factors or conditions that may have contributed to the incident, such as communication breakdowns, equipment failure, staffing issues, or inadequate training.

6. Actions taken: Documentation of any immediate actions taken to address the incident, including interventions, treatment plans, or changes in protocols or procedures.

7. Follow-up actions: Details of any additional actions taken to prevent future occurrences of similar incidents, such as education and training initiatives, quality improvement projects, or policy changes.

8. Reporting person information: Information about the individual reporting the incident, including their name, role or position, contact information, and any additional details deemed necessary.

It is important to note that the exact content and structure of the Saratoga form may vary depending on the organization or regulatory requirements in a specific healthcare setting.

How can I manage my saratoga form tax directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your saratoga form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit ht 4 tax in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your saratoga occupancy tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit tax office straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing county return saratoga form.